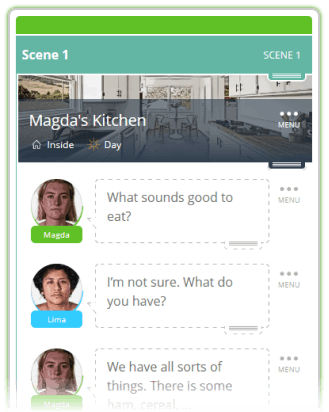

With one click

Export a perfectly formatted traditional script.

Ugh, tax season. It’s a dreaded time of year. Once it’s over, you don’t want to even think about it until tax season rolls around again the following year. But what if I told you that I had some tips to help screenwriters save some money on their taxes? Everybody loves saving money, so make an exception to open up that “taxes” part of your brain outside of tax season and keep reading to find out about tax write-offs just for screenwriters. You’ll want to keep track of these things as the year goes on.

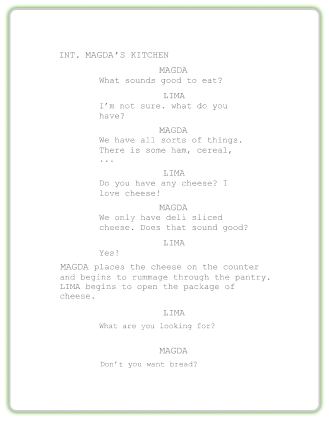

Export a perfectly formatted traditional script.

Heads up, I’m no tax professional, just another screenwriter that has to contend with taxes every year myself! If you have specific tax questions, you should contact a professional to assist with your tax filing. Here are some deductions screenwriters might find themselves able to write off:

To figure out your home office expenses, you can keep track of and add up the cost of things like printing, postage, notepads, and other supplies. Or, you can calculate a flat home office and supplies expense by taking the square footage of your office space and multiplying it by $5.

Have you had to travel for your career as a screenwriter? Trips you need to take for your business, business-related errands, and traveling from the office to appointments with clients can all be covered under this. It would also be appropriate to keep track of parking or toll costs, which you can deduct as well.

Health insurance premiums can be deducted as a personal expense if you find that an employer or spouse does not cover you.

If you find yourself racking up the expenses while job hunting, don’t worry, you can write most of them off! This can include a subscription to a job search platform or expenses incurred from traveling to and from interviews.

You might not have realized this one, but if you happen to use your cell phone for business, you can often deduct a percentage of the bill!

Entering into various screenwriting competitions can quickly add up. Be sure to keep track of all your contest entry fees, as you’ll be happy to hear that they’re deductible!

Have you spent any money promoting yourself and your services? Well, that’s deductible, too!

Be sure to deduct any manager or agent fees you pay as a cost of doing business.

Has researching your script cost you money? Don’t sweat it; you can deduct activities costs that helped you write your script! Even things like movie tickets can fall under this category.

Have you hired an editor or service to go over and give you notes on your script? Have you hired anyone else to help you with your writing career in some way? Deductible!

Have you attended any conferences, seminars, or film festivals that have aided in your professional development? The cost of those, along with travel and other expenses for these events, can be deducted.

Pay for screenwriting software? What about streaming services that you need for script research? Subscribe to a professional screenwriting magazine? Do you pay for web or email hosting? You can write off all of those software and subscription services you require for your writing.

If you’re like me and taxes stress you out, then I hope that this list of tax write-offs can give you something to be excited about come next tax season! A general rule of thumb: For something to be deductible, it must be ordinary and necessary in your profession, meaning something that’s a common thing to happen in your business or something that you reasonably expect will help your business. When in doubt, or if you have a tax question, don’t hesitate to reach out and ask a tax professional. Don’t forget to keep track of those expenses, and happy writing!