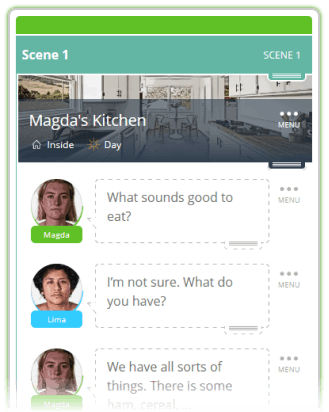

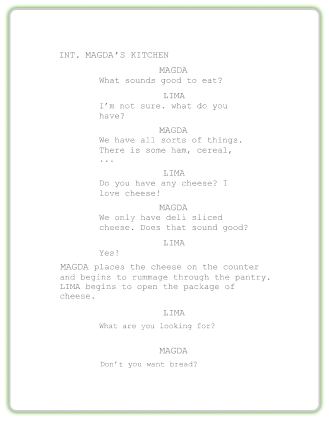

With one click

Export a perfectly formatted traditional script.

Making a movie is an expensive endeavor, even for low-budget films. Between cast, crew, locations, and equipment, the bill to produce a feature film often lands in the range of millions to tens of millions of dollars. For independent filmmakers already struggling to make ends meet, financing a film on their own is highly unlikely.

Luckily, filmmakers have many options to find the cash to finance their films if they know what they're looking for, including:

Development investors

Equity financing

Tax incentive investors

Debt financing

Gap financing

Tiffany Boyle, President of Packaging and Sales at Ramo Law, is an expert at pairing filmmakers and financiers. She's seen many financing scenarios and told us that the best financing option is the one that makes the most sense for your project.

Export a perfectly formatted traditional script.

Below, learn more about each type of film financing in Tiffany's own words so you can decide which financing route works for your film project and appear knowledgeable before approaching investors.

"There's a million ways to get a project financed. There are some more common ways," Tiffany began. "I would say if you have a clean script, you want to get your movie funded, to me, the step I'd take is, okay, let's find a producer, then a director. Hopefully, that director has enough clout or has some actors that are willing to get attached, and if they do, at that point, let's start approaching financing."

Before you look for film financing, you should find a lead producer and a director. Investors are much more likely to finance a project with these two key players attached at a minimum. A director and a film producer give your project a backbone and show that plans are already underway to make this movie.

"A lot of the time, writers have a tendency to think – and by the way, it used to be this way – oh, I'm a writer, I can just sell my projects, I can find an agent or a manager, and they do all the work for me. But the market has shifted a lot within the last ten to 20 years, and it's a lot harder," Tiffany explained.

"You need to be your own advocate for yourself. Often, people are hybrids. They are a writer and a producer or a writer and a director or a writer and XX so that you have more possibilities to do what you need to do to get your content made."

Screenwriters don't typically participate in film financing unless – as Tiffany mentioned above – they are writer/producers or writer/directors. However, whether you fall into the former category or the latter, it is always good to understand the entertainment business, especially how films get made.

Film financing typically falls on the producer's task list for independent films. This is why it's so important to bring a producer onto your project early on.

Based on the film's budget, shooting location, and distribution plans, the producer will pull together one or more of the financing options below.

"There are development financiers who will just cover certain development costs, and those can be great, but a lot of them don't get involved unless they're passion-driven, and it's really hard to find those. Or, again, they're based off of IP, so it's a book you want to turn into a script or a comic book or a true story. Those can be avenues where you can find that development financing."

Development funding is risky for investors and expensive for producers. Development financiers usually demand to recoup their costs and earn a percentage of the film's profits.

Development financing can cover the producer's pay until the film starts earning money, hire screenwriters for writing and rewriting a screenplay, assemble professional pitch decks and marketing materials, and cover costs associated with traveling to markets and festivals to seek additional funding.

"Outside of that, there's equity. Equity is really the best option for most people if they can find it. And those are people that are coming in with financing and saying, hey, we will come in with X-amount, we want to be recouping alongside any other investors you put in at the same time, and we're willing to be first or last. They tend to be a bit more open."

Investors will provide partial funding for a movie in exchange for partial ownership, then earn a percentage of profits when the movie hits the box office. If the movie doesn't earn any money, the investor loses out on their investment.

"Then there are other avenues like, you're shooting in Georgia, and you have a tax incentive, so you need to find a tax incentive investor. Tax incentive investors tend to be the easiest money to find, so it's not super helpful when you come to the table and say, "I have a tax incentive investor."

But, it can help with your financial plan to say, "I have a $1 million movie, I'm shooting in Georgia, we're going to get $200,000, so I only need to raise $800,000." That helps people wrap their heads around, okay, so it's a bit less risk for me if I come in with $400,000 or something."

Some states offer significant tax incentives for shooting in their location, using local resources, and hiring local crew and talent. Usually, states award these tax incentives after production is finished, so you won't be able to use this cash to cover production-related expenses right away. However, some financiers will offer a cash loan against that tax incentive amount, freeing the capital to use sooner.

"Then there's debt. So let's say you presell your movie to somewhere in the United States, and they pre-buy it for $300,000. Somebody can paper that sale for you so you can go to production because a lot of the time, distributors will say, "Hey, when you deliver me the movie, I'll pay you $300,000." So, you can kind of almost bank that paper if it's a quality-enough distributor."

Consider debt financing to be a loan borrowed against a pre-sale amount promised to you by a distributor for a completed movie. This loan must be repaid, and usually with interest.

"Then there's gap. Gap sits somewhere in the middle of debt and equity, and they tend to say, "Okay, you have this great sales agent on board. You've done $300,000 in pre-sales already. There's $200,000 more you think you're going to do. We'll bank against your $200,000 you think you're going to do paper because we have faith in you, but we recoup before the equity does."

Gap financing allows producers to close the gap in their fundraising efforts by taking an investment in the amount they think they will be able to bring in before production begins. This financing must be paid back before any equity investors receive a financial return on investment.

"And there are other kinds of different avenues, but those are the really big ones that you need to think about. And playing with what kind of investments do you think you can raise, with who, what kind of distributors this could be for, therefor are they going to be putting up minimum guarantees for you, or is this really tough drama, but it's a really good script so you're probably going to need all equity because there probably won't be a pre-sale.

You really have to think those through as you're building a package."

And this is by no means an exhaustive list of investment types when it comes to financing a film project. Filmmakers get creative with their independent film financing, incorporating film grants where applicable, crowdfunding, private investors, and more.

Did you enjoy this blog post? Sharing is caring! We'd SO appreciate a share on your social platform of choice.

It becomes a little less intimidating to determine how you'll finance your film project when you know where to look. From equity to gap financing, there's no one-size-fits-all approach because financing is as unique as your movie. So, the more you know, the better off you'll be!

Stack your odds so you can stack those checks,